The news that ASML holding new aspirations to take a move to overtake the LVMH on AI boom to become Europe’s second most valuable company makes the ASML Holding stock catch the investor’s eyeballs.

Is ASML Holding stock a good buy in 2024?

Is Asml Holding Nv Stock a good buy in 2024, according to Wall Street analysts? The data came from the consensus of 5 Wall Street analysts covering ASML holding (NASDAQ: ASML) stock is to Strong Buy ASML stock.

What is the risk of ASML Holding?

ASML Holding NV shows a Risk Score of 7.00. According to the latest data available on the history of its YTD performance is 37.84%.

ASML holding dividend history

Ex-Dividend Date 04/26/2024 ; Dividend Yield 0.78% ; Annual Dividend $7.4928 ; P/E Ratio 44.89.

Is ASML a good dividend stock?

How does ASML dividend yield compare to the market? Notable Dividend: ASML’s dividend (0.7%) isn’t notable compared to the bottom 25% of dividend payers in the US market (1.52%). High Dividend: ASML’s dividend (0.7%) is low compared to the top 25% of dividend payers in the US market (4.7%).

Who is ASML biggest customer?

The company’s recent surge was helped by the news that its biggest client, chipmaker Taiwan Semiconductor Manufacturing Co., will receive the high-NA extreme ultraviolet machine by the end of this year.

What is the outlook for ASML in 2024?

According to the CEO statement and outlook

ASML expects R&D costs of around €1,070 million and SG&A costs of around €295 million. Our outlook for the full year 2024 is unchanged, with the second half of the year expected to be stronger than the first half, in line with the industry’s continued recovery from the downturn.

How many countries is ASML in?

It has offices in the Netherlands, the United States, Belgium, France, Germany, Ireland, Israel, Italy, the United Kingdom, China, Hong Kong, Japan, South Korea, Malaysia, Singapore, and Taiwan. The company is listed on both the AEX and NASDAQ Stock Exchanges.

Who is ASML biggest competitor?

Should you be buying ASML stock or one of its competitors? The main competitors of ASML include Lam Research (LRCX), Oracle (ORCL), Salesforce (CRM), Advanced Micro Devices (AMD), Adobe (ADBE), Cisco Systems (CSCO), T-Mobile US (TMUS), QUALCOMM (QCOM), Intuit (INTU), and International Business Machines (IBM).

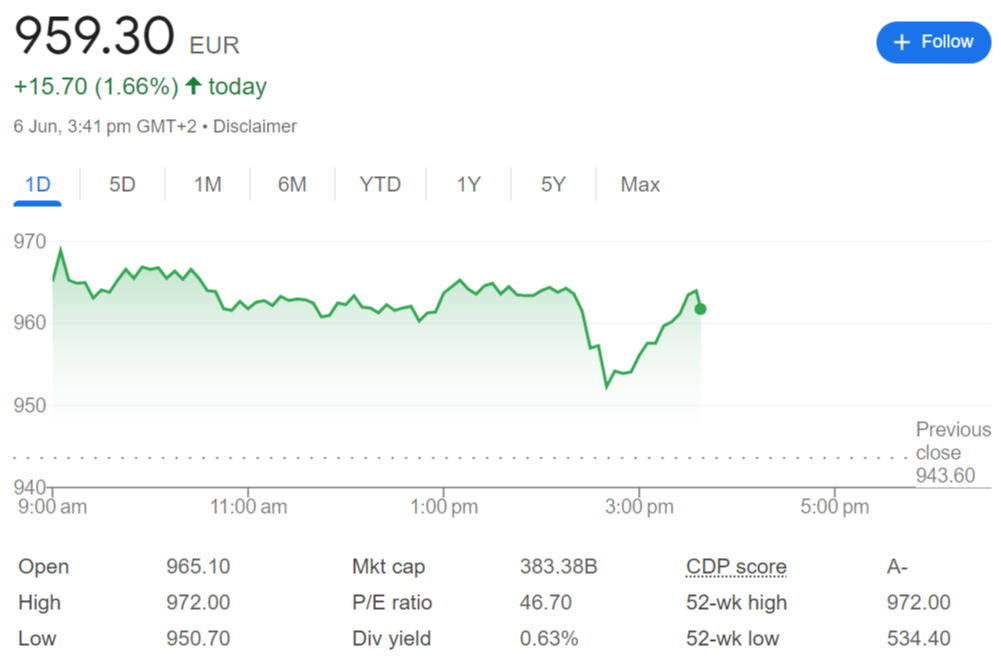

The Shares in ASML Holding stock have surged 9% since markets opened on Wednesday, June 5.2024 on the back of a rally in Nvidia’s share price that saw the California chip designer overtake Apple to become the second most valuable company in the world, worth more than $3 trillion.

The market capitalization of ASML Holding was lifted to heights of €384 billion ($417 billion), making it Europe’s second most valuable company, ahead of LVMH at €381 billion, but still behind Danish pharmaceutical giant Novo Nordisk which is worth €425 billion.

The world’s top manufacturer of the most advanced semiconductors, TSMC, is a major supplier of chips to Nvidia (NVDA) and Apple (AAPL). ASML Holding’s ‘High NA’ machines are able to imprint lines on chips that are just 8 nanometers thick, rates 1.7 times smaller than the next most-advanced tech.

ASML Q4 results

ASML Q4 2023 fourth-quarter and full-year financial results on Wednesday, January 24, 2024 with net profit rose 9% to 2.0 billion euros ($2.2 billion) on sales of 7.2 billion euros in the fourth quarter.

ASML Q3 Results

ASML Q3 2023 financial results announced on Wednesday, October 18, 2023 with net sales of €6.7 billion, gross margin of 51.9%.

Here’s how ASML did in the third quarter versus LSEG estimates:

Net sales: 6.67 billion euros ($7.1 billion) versus 6.71 billion euros expected

Net profit: 1.89 billion euros versus 1.8 billion euros expected

Why Analysts of BANK of America Are Bullish on ASML stock?

Bank of America’s analysts now believe that ASML could generate €40 billion in revenue in the full-year 2025, on the back of surging demand for its lithography machines as a result of the artificial intelligence boom.

ASML Holdings Target Price

The analyst at Evercore ISI initiated ‘Outperform’ on ASML Stock on April 16,20124. The analysts at HSBC Securities initiated a ‘Buy’ on ASML Stock on Feb 22, 2024.

Disclaimer: The information provided on this usmarketwire is for informational purposes only and should not be considered as financial or investment advice. Investing in the stock market involves risks, and you should consult with a qualified financial advisor before making any investment decisions. US Market Wire is not responsible for any losses incurred as a result of using this information. All opinions expressed are those of the authors and do not necessarily reflect the views of US Market Wire.