As markets continue to evolve, three major stocks—Microsoft, Unity Software, and Amazon—are capturing the attention of investors due to their respective advances in cloud consumption, gaming software, and artificial intelligence. Here’s a closer look at why these stocks are worth buying right now.

Microsoft: Cloud Visibility Grows With New Reporting

Microsoft (MSFT) shares are up 0.078% in pre-market trade on Thursday, August 22, 2024, and it is making significant strides in cloud visibility, a key growth area for the tech giant. The company recently announced changes to its financial reporting, aimed at giving investors a clearer picture of its cloud consumption trends. This shift will allow for greater transparency into the financial performance of Microsoft’s intelligent cloud division, which includes the Azure platform.

By focusing on cloud consumption metrics, Microsoft is positioned to enhance investor confidence in the robustness of its cloud infrastructure. This transparency is essential as companies worldwide increase their reliance on cloud services for everything from data storage to AI operations. With a market cap of $2.48 trillion, Microsoft remains one of the leading cloud providers, standing tall in a sector poised for further growth.

According to analysts, Microsoft’s decision to offer more granular data on cloud consumption could catalyze a new wave of investment in the stock. With consistent growth in its cloud division and new strategies to boost visibility, Microsoft is a strong buy for long-term investors.

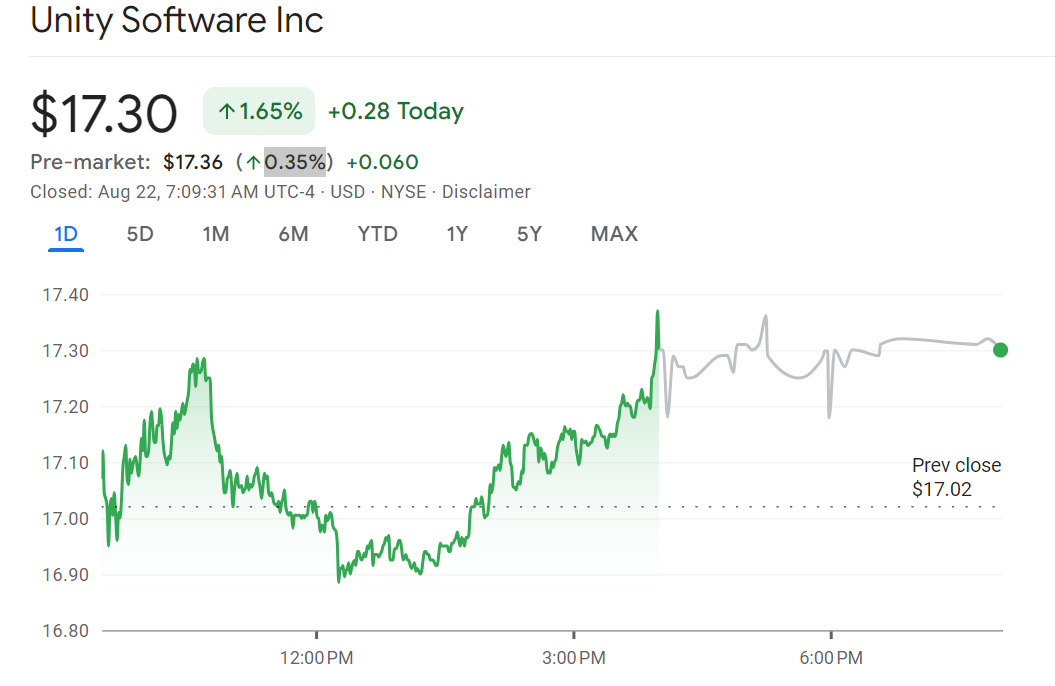

Unity Software: Insider Selling Signals but Still Bullish Long-Term

Unity Software (U) Shares edged up in pre-market on Thursday, August 22, 2024, and it continues to stand out as a powerhouse in the gaming industry, despite recent insider selling activity. According to reports, a Unity Software director recently sold shares worth over $13,000. While insider selling may raise some concerns, it’s important to remember that this could be part of routine diversification and should not overshadow the long-term potential of Unity as a leader in gaming and 3D content creation.

Unity is responsible for providing the technology that powers nearly half of all video games globally. The company’s cross-platform tools enable developers to create real-time 3D projects across various industries, including entertainment, architecture, and even automotive design. Despite fluctuations in stock price, Unity’s dominance in the gaming software market makes it a valuable buy for investors who are confident in the continued expansion of gaming, augmented reality (AR), and virtual reality (VR) markets.

Given the ever-growing demand for real-time 3D content and the expansion of metaverse projects, Unity’s stock is seen as a strong long-term investment in the tech sector. The potential for growth remains high, especially as companies and developers continue to invest heavily in immersive experiences.

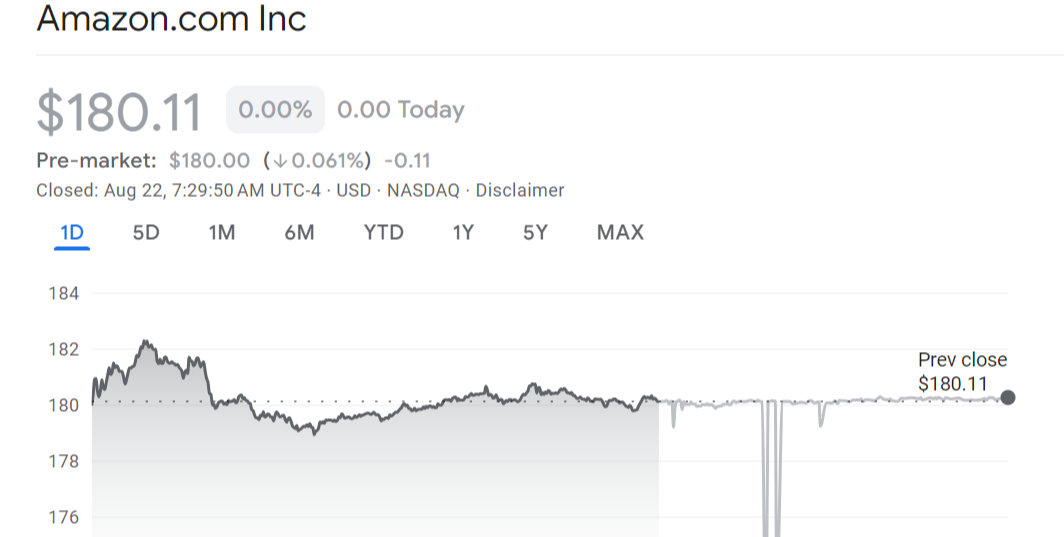

Amazon: AI Surge Drives Renewed Optimism

Amazon (AMZN) shares are gaining 0.38% in pre-market trading on Thursday, August 22, 2024, as become a major player in the AI space, with its AI efforts driving substantial growth and innovation across its operations. Recently, a top market strategist doubled down on Amazon’s stock, citing the company’s multi-billion-dollar run rate in AI as a major factor for this bullish stance. Amazon’s investments in AI are not limited to its cloud computing arm, Amazon Web Services (AWS); they extend into logistics, retail, and voice-assistant technology.

Amazon’s AI innovations are evident in its recommendation engines, voice-controlled devices, and its continued push toward automating key parts of its supply chain. AWS, which is responsible for a significant portion of Amazon’s profits, has been aggressively expanding its AI offerings, providing customers with a wide range of tools for machine learning, data analytics, and automation.

With a market cap of $1.36 trillion and a history of innovation across e-commerce, cloud computing, and now AI, Amazon is positioned for continued growth. Investors are particularly bullish on Amazon’s ability to leverage AI to drive future revenue, making it a strong buy for those looking to benefit from the AI revolution.

Conclusion:

With all three companies making significant advances in their respective sectors, Microsoft, Unity Software, and Amazon are poised to deliver long-term value to investors. Microsoft’s cloud consumption metrics, Unity’s 3D content creation tools, and Amazon’s AI-driven growth make these stocks compelling buys in a rapidly evolving market.